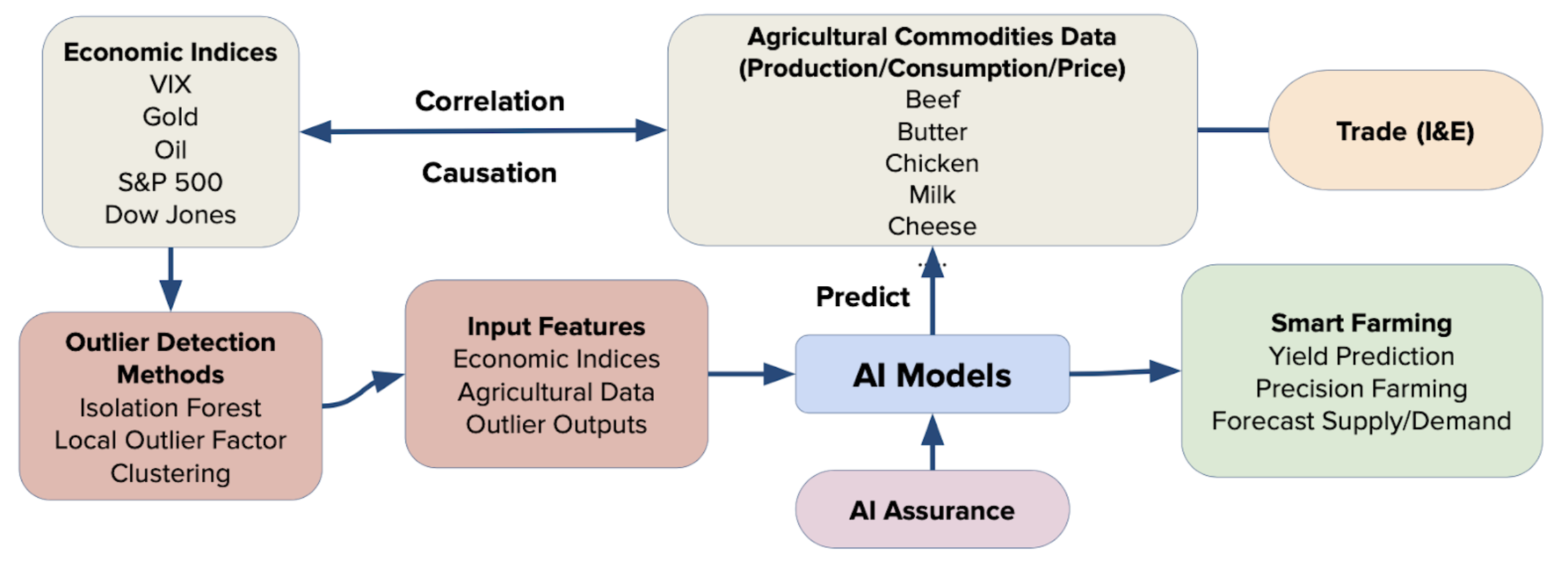

Commodity production is tightly coupled with macro shocks—trade wars, pandemics, market crashes, and extreme weather. DeepAg builds an outlier-aware pipeline: (1) detect rare events in financial indices using Isolation Forests after double-rolling normalization, (2) learn causal/correlated pairings between indices and commodities, and (3) forecast production with an LSTM that explicitly includes outlier flags. Across 15 commodities, outlier-aware DeepAg improves RMSE over baselines and the same LSTM without outlier inputs; isolation-aware models capture shock-driven surges that classical regression misses.

DeepAg: Outlier-Aware Agricultural Forecasting

DeepAg fuses isolation-forest outlier detection with LSTM forecasting to quantify how financial shocks, weather, and political events reshape agricultural production. The framework couples causation/correlation screening with multi-step multivariate forecasts, delivering scenario-aware production guidance.

Abstract

Research Questions

- Do macro outlier events (economic, financial, weather, political) materially change agricultural production forecasts?

- Can an LSTM conditioned on detected outliers outperform regression and tree baselines on multi-step commodity production?

- Which financial indices causally drive each commodity, and how does causation differ from correlation?

Data & Context

Financial indices (Yahoo Finance, 2000–2019): Gold, Crude Oil, DOW, S&P 500, VIX (daily close).

Commodities (USDA NASS QuickStats, monthly): Beef, Butter, Cheese, Chickens, Ducks, Eggs, Ice Cream, Lamb/Mutton, Milk, Other Poultry, Pork, Sherbet, Turkeys, Veal, Water Ices.

Outlier events: detected over indices; mapped to economic, financial, weather, or political shocks.

| Index | Contamination (%) |

|---|---|

| VIX | 6.56 |

| S&P 500 | 6.01 |

| DOW | 6.13 |

| Gold | 5.38 |

| Crude Oil | 3.95 |

Method

Pipeline

- Normalize indices with DoubleRollingAggregate; flag anomalies via Isolation Forest.

- Compute causation (DoWhy) and correlation to select driver indices per commodity.

- Train multivariate LSTM (lookback 60, forecast ≈30 monthly steps ≈5 years) with and without outlier flags.

- Compare against regression, trees, and boosting baselines.

Hyperparameters: MinMax scaling; contamination from IQR; multi-step horizon; RMS-based evaluation.

Two-stage flow: anomaly detection on indices → causal screening → LSTM forecasting with outlier inputs.

Outlier Detection

Isolation Forest isolates rare partitions quickly; contamination is set from interquartile spread. Outlier flags are fed to the LSTM as an input feature so the forecaster can reshape trajectories during shocks.

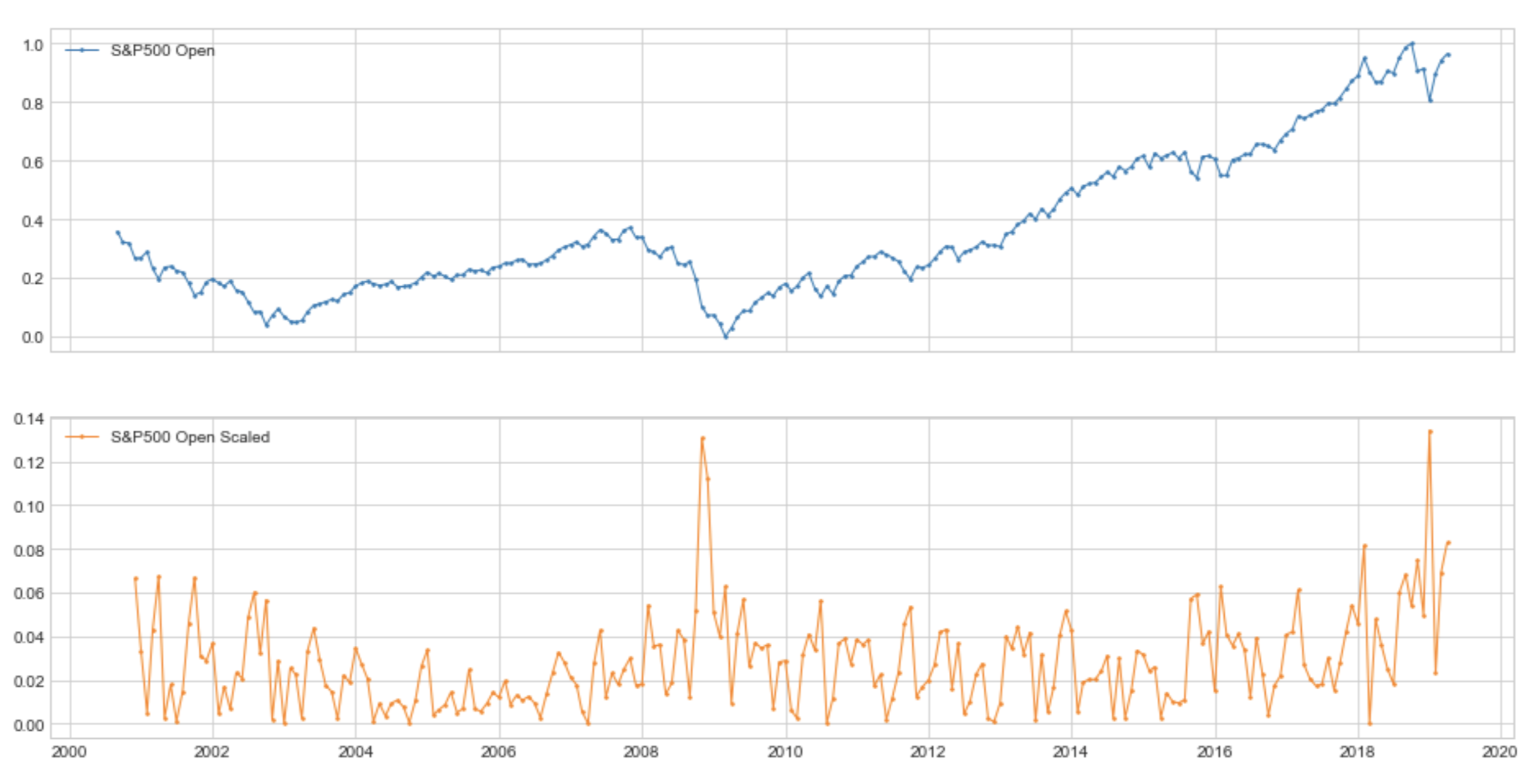

DoubleRollingAggregate scales S&P 500; anomalies become separable.

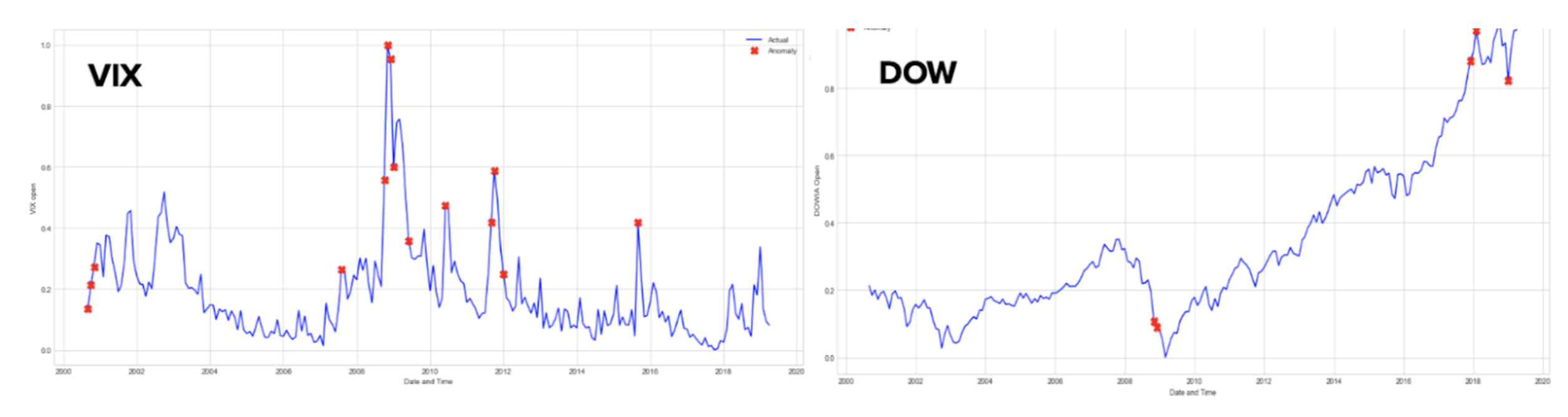

Red markers: detected outliers aligned with trade wars, recessions, and major shocks.

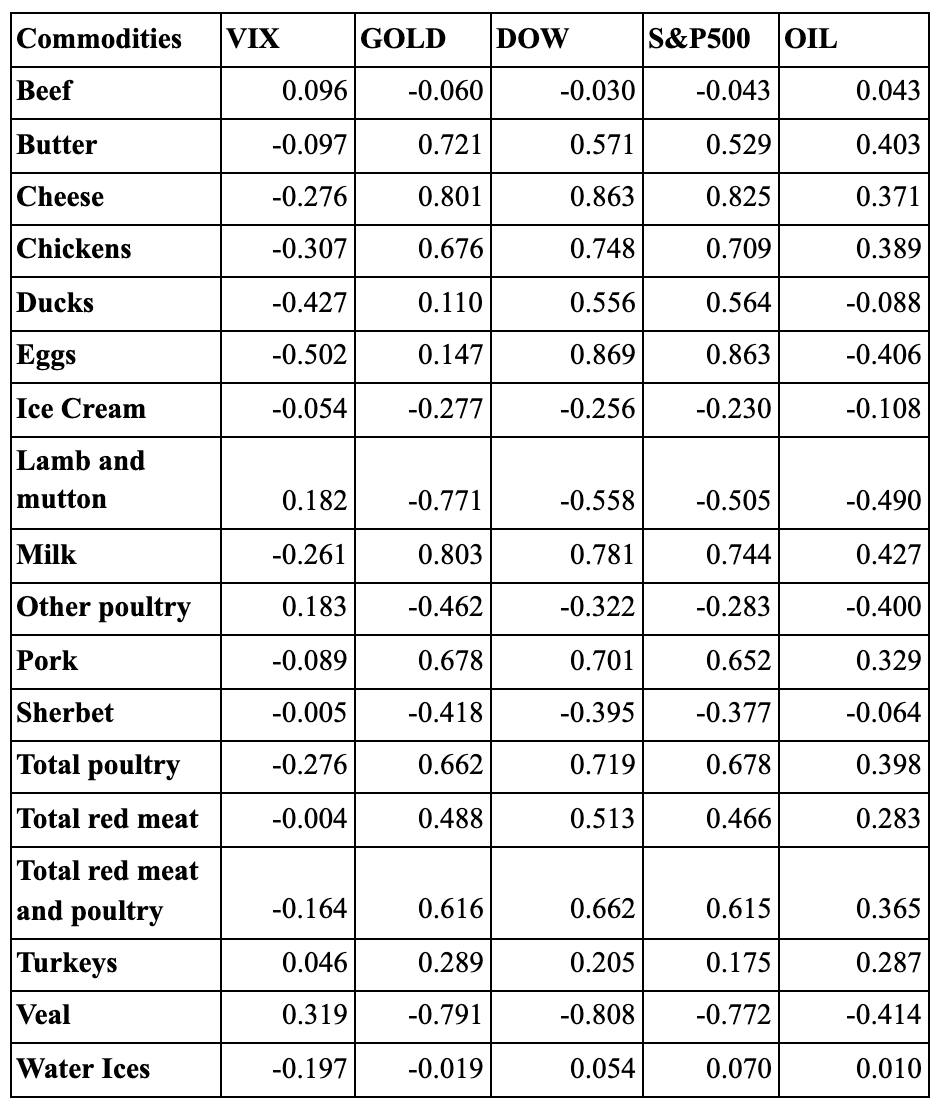

Causation vs Correlation

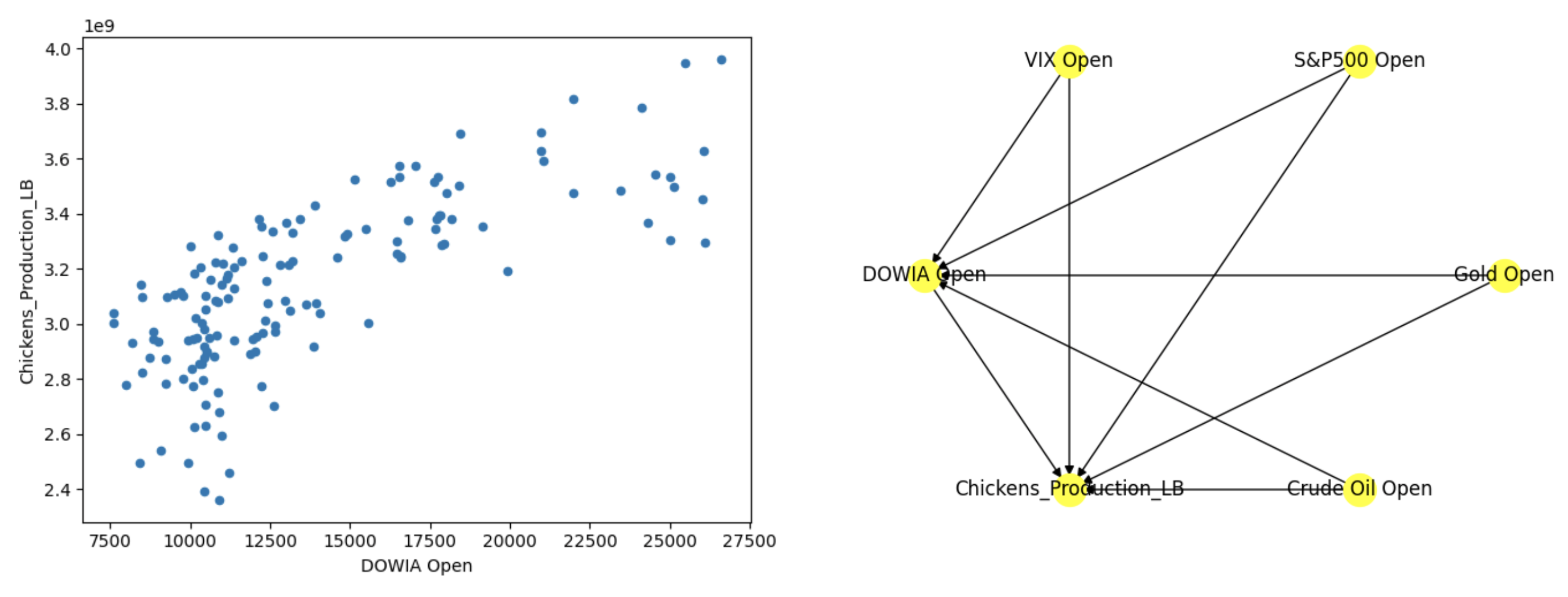

DoWhy causation scores often diverge from raw correlations. Meat and dairy show strong causation from DOW/S&P; VIX exhibits weaker influence. DeepAg pairs each commodity with its top causal and correlated index before forecasting.

Causation matrix: DOW and S&P are dominant drivers for many commodities.

Correlation vs causation for chicken production and DOW.

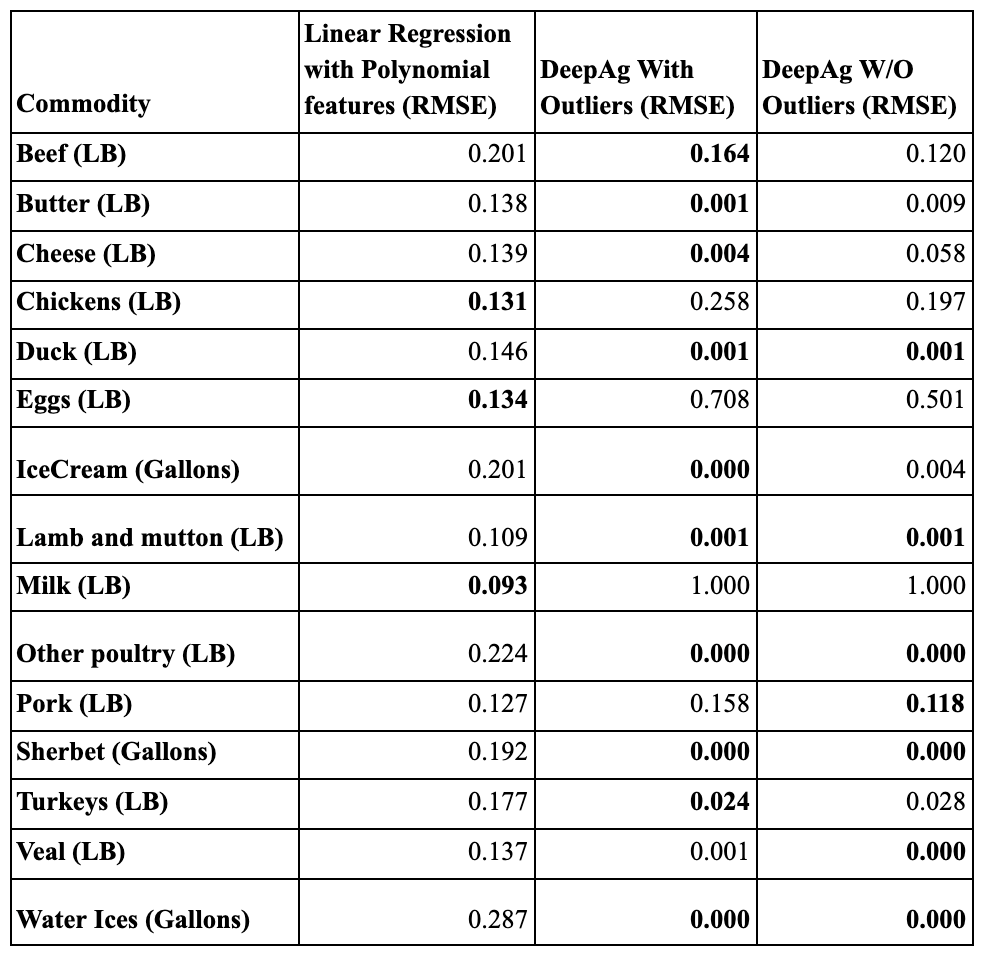

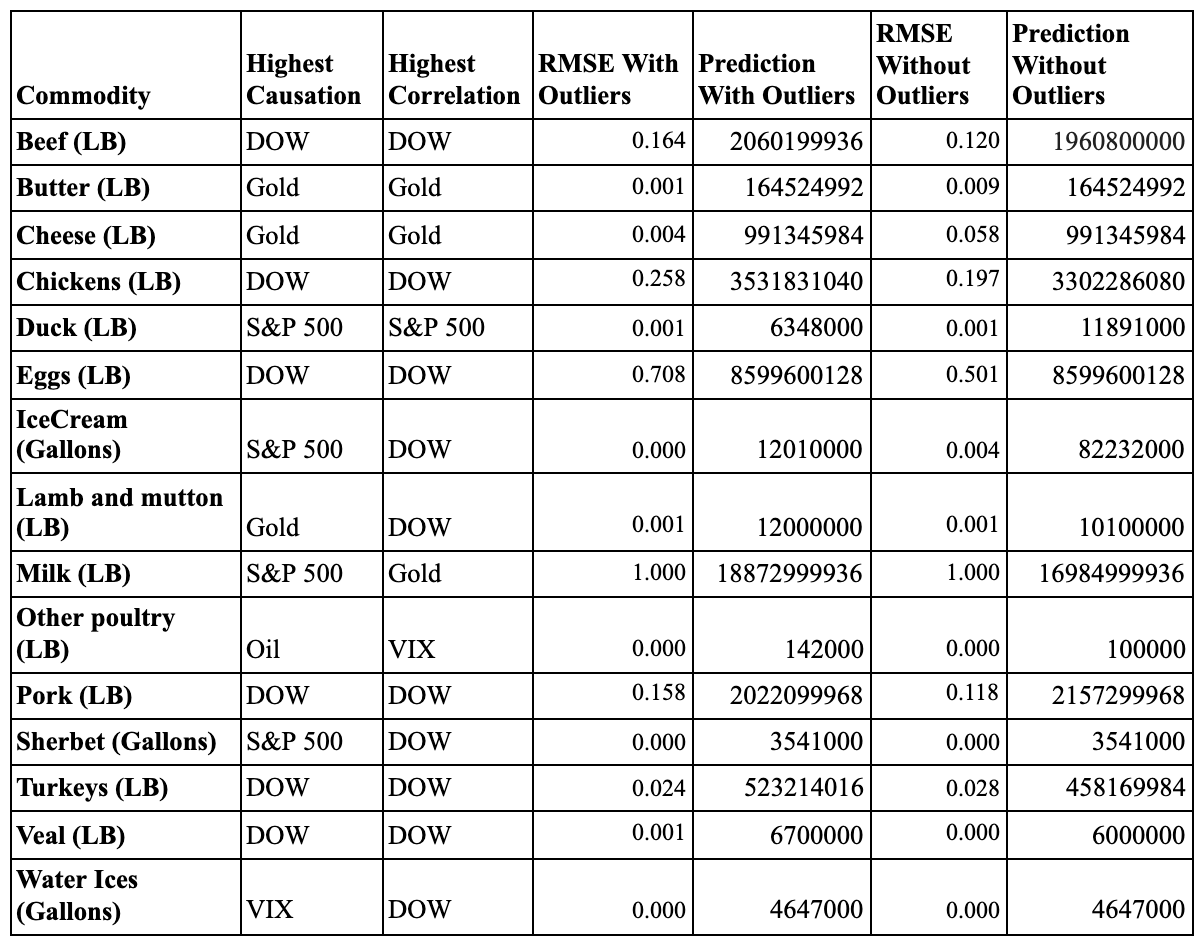

Results

| Commodity | Best baseline | DeepAg (with outliers) | DeepAg (no outliers) |

|---|---|---|---|

| Butter | 0.138 (Poly Reg) | 0.001 | 0.009 |

| Cheese | 0.139 (Poly Reg) | 0.004 | 0.058 |

| Beef | 0.201 (Poly Reg) | 0.164 | 0.120 |

| Chickens | 0.131 (Poly Reg) | 0.258 | 0.197 |

| Turkeys | 0.177 (Poly Reg) | 0.024 | 0.028 |

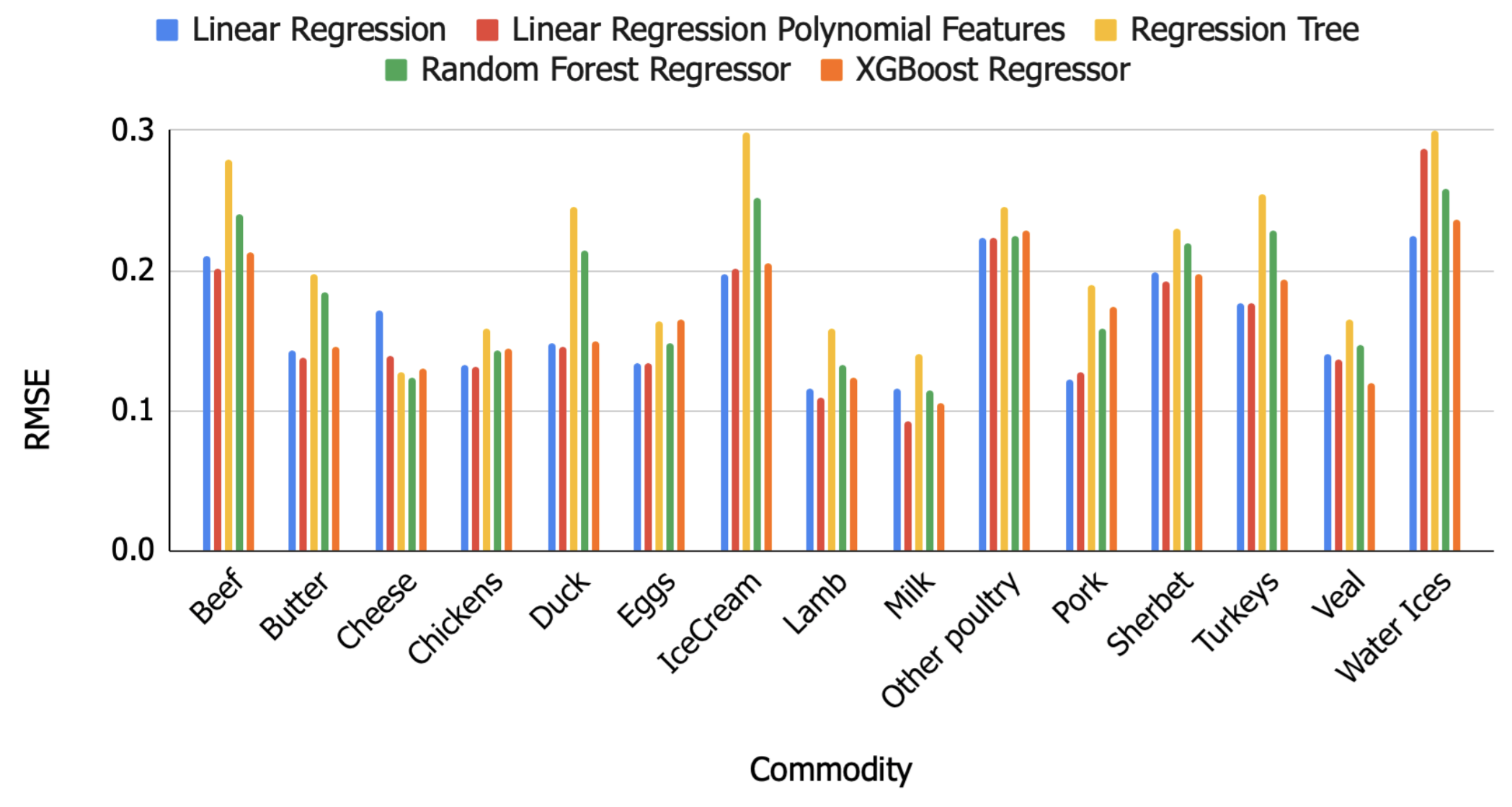

Outlier-aware LSTM improves most commodities; a few steadily trending series (e.g., chickens) remain competitive for linear regressions.

Baseline RMSE across models.

DeepAg forecasts with/without outliers across 15 commodities.

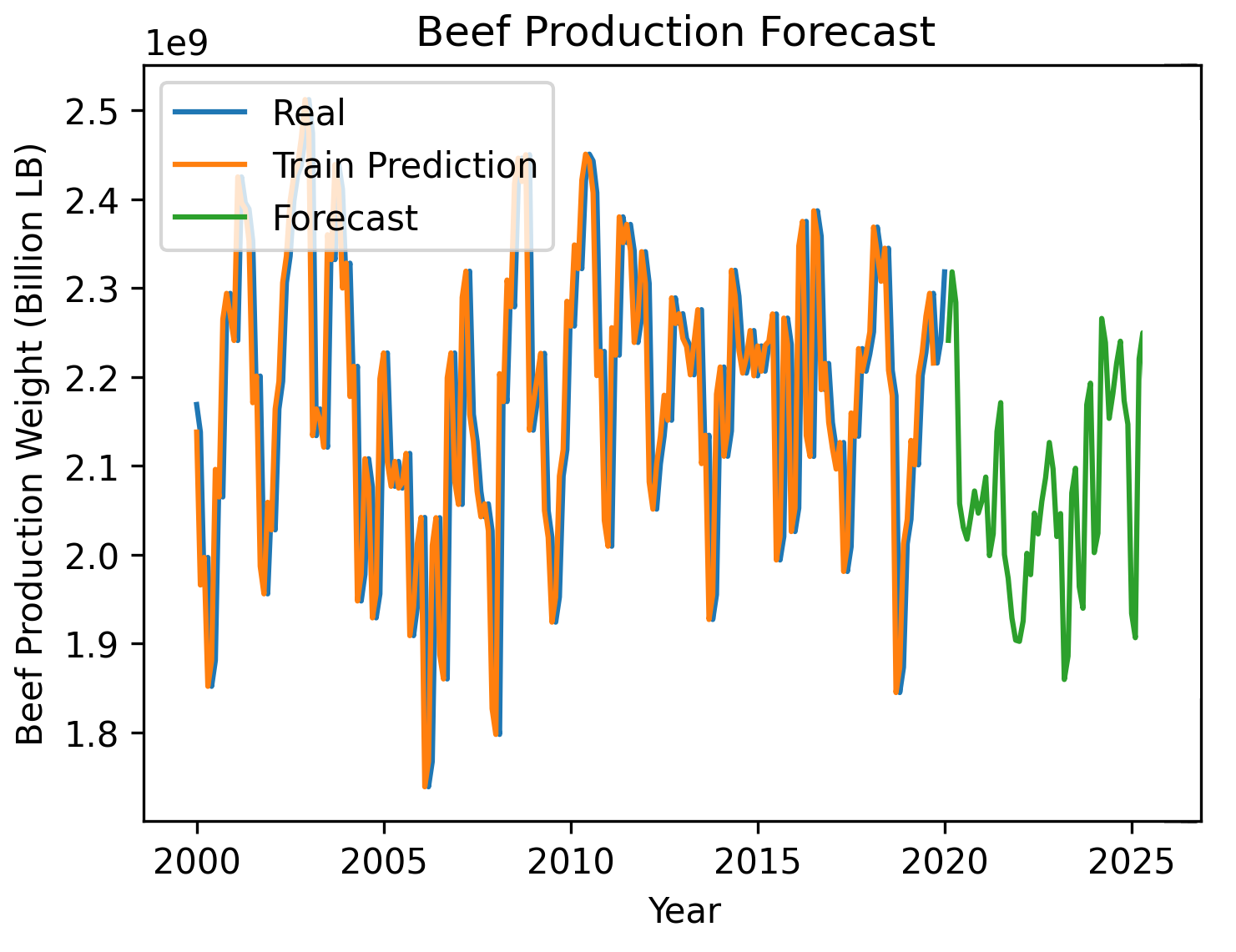

Forecast Examples

Chicken production 2020–2025 with and without outlier inputs.

Beef production forecast; outlier-aware model captures shock-induced swings.

Policy & Operational Insights

- Outlier flags help quantify production shifts during trade wars, recessions, and natural disasters—useful for USDA/FAO policy scenarios.

- Producers can plan labor, inventory, and pricing around interval forecasts that condition on shocks.

- Better shock modeling mitigates food waste by smoothing release of supply during demand spikes.

Gallery